There is quite a bit of uncertainty on where the PSEi will eventually close at during the year end. Early in the year, initial estimates put the figure at an optimistic level of 7200 to 7400, which was subsequently adjusted downwards to 6500 to 6600 level, following the correction that happened after May of this year. Given the current movement of the index during the start of november, that may now even seem to be a bit of a stretch. Especially if the markets continue to weaken. As of this writing, the PSEi was down to 6297.11 (10:05 am. 11/19/2013).

I decided i would give a shot at making an estimate of what the PSEi will close at for the year-end, so i decided to dig up a paper i worked on back in university, on “Forecasting Philippine Stock Market Returns with Macroeconomic Variables”. This will actually be an extension of my previous work, using new additional sets of data from the years after the periods covered in the paper. I specified and estimated a model of the Philippine Stock Market (Proxied by the PSEi), with the independent variables Country Risk (Now Proxied by CDS 5 Yr.), Industrial Production, USD/PHP Exchange rate, 10 Y Treasury Bond (PDST-F 10 Y), and the Inflation rate.

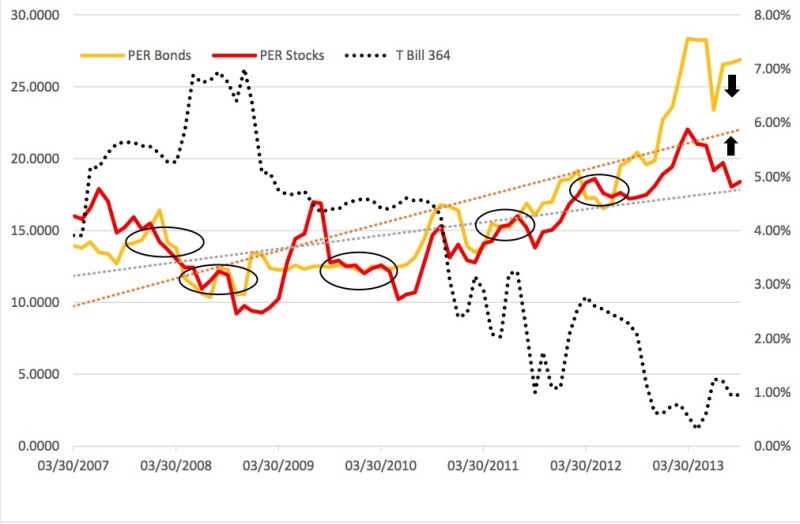

The graph above shows the estimated and actual values of the PSEi, the specified model does a decent job of estimating the PSEi, although it isn’t perfect, but having an estimate is always better than pulling a number out of thin air. The model forecast that the PSEi will end the year at the 6600 level, and will climb to 7900 and 8800 levels for 2014 and 2015. respectively. These forecast are based on plugging in estimated values for the independent variables for the years concerned. Although it is important to note that the model is only as good as the variables that come into it.

On a totally unrelated note, and just for the fun of it, although i’m not a chartist, there seems to be a consolidating triangle pattern forming for the price movements of the PSEi as of yesterday(11/18/2013). The PSEi can go either up or down, if it pierces the next low, then the PSEi may fall sharply and continue to weaken.

For more information on the model, or any questions, you may contact me.