In the light of the recent developments in the financial markets abroad, such as the uncertainty of the U.S Federal Reserves’ short to medium-term monetary policy stance, and the strengthening of the developed world economies (U.S, Europe), investor sentiment has been shifted away from emerging markets, such as the Philippines, and back into the financial markets of the developed world. This has resulted in an exodus of the portfolio investments from emerging markets, which has devastated emerging market currencies, reversing the year to date gains of the Philippine peso back to negative territory and has had a profound effect on the local interest rates in the Philippines over the past few months. Local interest rates have since transitioned back into a seemingly temporary lows, but given these developments, it is quite clear that we are entering into an environment of rising interest rates, which will impact bond prices, due to the inverse relationship of bond prices and interest rates/yields.

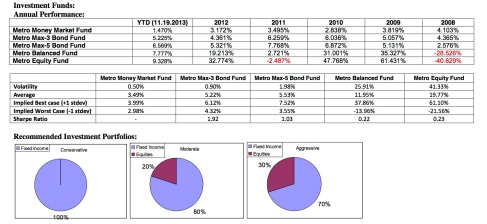

In a rising interest rate environment, we recommend fixed income investments in instruments with tenors of less than 5 years, due to the lower level of interest rate sensitivity of lower tenor bonds. We recommend an investment in the Metro Max-3 Bond fund, since the fund is primarily invested with short to medium term fixed income instruments that are less sensitive to interest rate risk. The fund has a weighted term to maturity of only 3.06 years and duration of 2.32. Historical returns of the Max-3 Bond Fund have been relatively stable with an average of 5.212% and a standard deviation (Volatility) in returns of only 0.90%.

Depending on your risk appetite, you may either choose to be 100% fully invested in fixed income instruments or may allocate a portion of your portfolio into equities in order to increase the upside potential of your investment, which may come at the expense of greater risk in terms of volatility of returns. Should you be willing to bear the additional risk, we recommend an investment in equities via the Metro Equity Fund, of at least 20-30% of your portfolio. This will give you an opportunity to directly capitalize on the transformation of the “Sick Man of Asia” into one of the fastest growing economy in Asia. The acceleration of growth in the Philippines over the next 2 years, with GDP growth expected at 6.5 – 7% for this year, and in the 6-7% range for the 2014 and 2015, will be a positive for the stock market, as an increase in economic activity led by robust consumer spending, will drive up corporate earnings.

Typhoon Haiyan a net positive in terms of economic impact: Despite market’s negative reaction to the tragedy that is Typhoon Haiyan, the economic impact is expected to be muted, since production in the worst hit regions consist mostly of low value goods, while the economic contribution of the overall affected regions would only compromise of roughly 12% of the economy. The bulk of the effects are expected to be only short-term with inflation temporarily spiking at 3-4% in the last two months of the year and in the first quarter of next year in response to food production losses and supply chain disruptions. while, GDP growth rate is still expected to take a slight hit of 0.40% for this year, which may put full year growth below the 7% level, but still comfortably between 6-7% for the year. The typhoon may even be considered a positive for the Philippine economy, with reconstruction efforts, estimated to cost P250B (2.31% of Philippine GDP), seen to supplement the economic growth in the coming years.

As you can see on the tables above, periodically rebalancing the portfolios at year end back to their original allocation weights has provided for incremental returns over the similar set of portfolios that were not rebalanced. In the case of the moderate fund, the difference in annual compound returns is 0.922%. while, for the the aggressive portfolio, the difference in annual compound returns is 1.214%. Clearly, period rebalancing has been beneficial.

Disclaimer: Author is currently affiliated with Metrobank, although he derives no commissions from actual bookings that may result from this recommendation. This article was created to show the authors views and recommendations on Metrobank’s UITF Products, and an objective description of the historical performance of such.

To get the latest updates on Metrobank’s UITFs, inquire at the Metrobank nearest to you.